The state of cryptocurrency theft - Cryptocurrency malware is now an economy

- $1.1 billion – the amount of cryptocurrency-related thefts during the last six months

- 12,000 – the estimated number of dark web marketplaces

- 34,000 – the number of cryptocurrency-related theft offerings

- $6.7 million – the monetary worth of the illegal economy comprising cryptocurrency-related malware development and sales

- 55,000 cryptocurrency users affected in Bitpoint's $28 million hack

The dark web is synonymous with illegal trade in, amongst others, malware, and malicious hacking tools. This market has now turned towards cryptocurrency (Bitcoin, Ethereum, and Monero) theft, a very lucrative endeavour as it turns out. And, unfortunately, as interest and business opportunities linked with cryptocurrency peak, so does the interest from criminals. This has quickly turned into a new economy in the world of hacking tools and software.

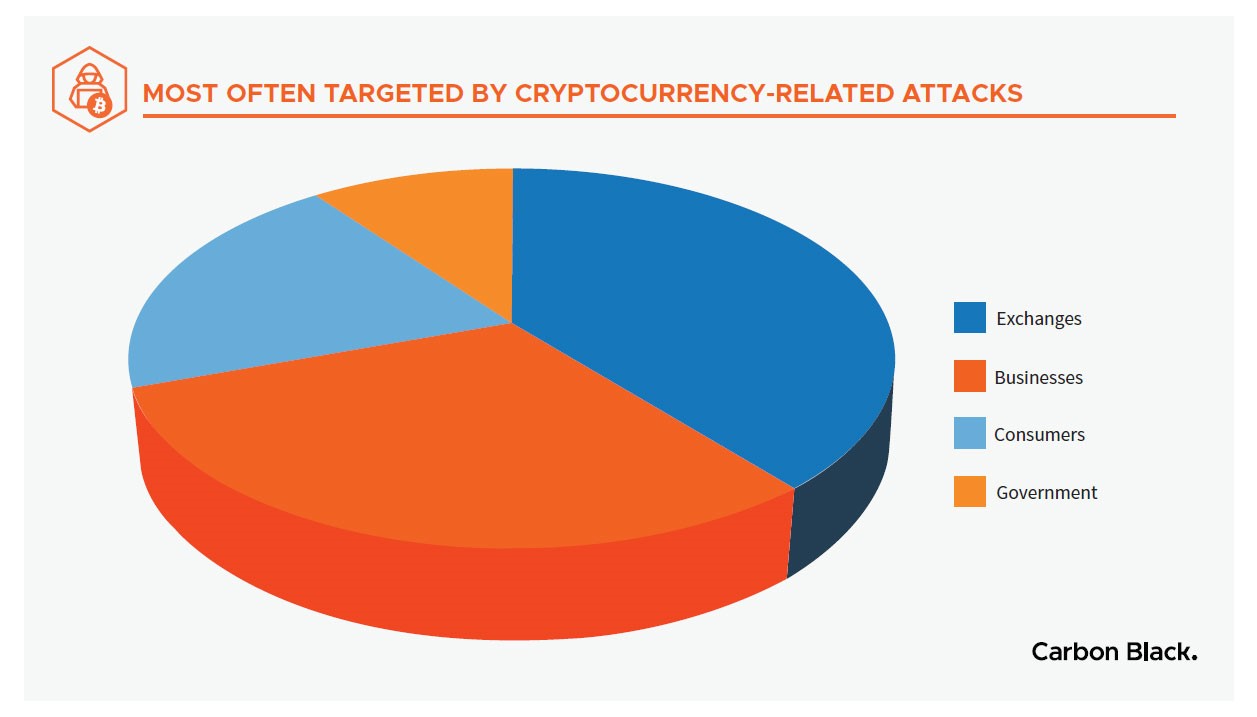

It is furthermore clear from the chart below that businesses are the favourite targets of cryptocurrency theft.

The Q1 2019 Cryptocurrency Anti-Money Laundering Report confirmed that cryptocurrency theft and exchange scams amounts to more than $356 million in Q1 2019. If this trend continue, the cryptocurrency theft economy can become a near billion-dollar money laundering problem.

The bulk of cryptocurrency-theft events relate to Bitcoin most probably due to the virtual currency's popularity and potentially high returns. The biggest problem related to cryptocurrency trade (and no doubt something that Cyber criminals exploit) is that you cannot police what you cannot see. Many digital assets are not associated with or controlled by governments or banks. But the price they have to pay for being free from the institutions of global capitalism can be extremely high as is evident from the statistics above. A further problem that arises is that this also means that victims of cryptocurrency theft have no institution or body (yet) to appeal to for recourse. Add that to the irreversible nature of blockchain transactions and you have a scenario where it is nearly impossible to recover money once it's gone.

The Group of Twenty has very recently, at the 2019 G20 Summit, declared its support for implementing cryptocurrency guidelines. The aim of these guidelines would see exchanges hand over user data to regulators. It further recommends establishing regulatory bodies to oversee cryptocurrency exchanges and services, also known as virtual asset service providers. This should be done by adopting a risk-based approach to address cryptocurrency based theft and laundering.

These guidelines will be welcomed.

Until then the MIRkey offers strong security key authentication with most known account services - including Coinbase. Additionally, as a hardware wallet, the MIRkey allows you to store, send, and receive digital currency safely. It is crucial to ensure that the coin's private keys are secure if you purchase or trade in cryptocurrency. The MIRkey integrates seamlessly with popular software like Electrum and allows you to easily send and receive currency while still keeping the private key safe on the MIRkey - even if your computer is compromised.

Robert Kellerman

Marketing consultant for ellipticSecure.Robert Kellerman is an engineer who specialises in technical marketing. He loves his family, making music, hiking and surfing. He is a bit of a coffee fanatic and roasts his own beans. He lives in Somerset West, Cape Town.